Yelp: Local Economic Impact Report

September 2020

If you'd like additional detail on how the economy is shifting, please contact us at press@yelp.com or join our mailing list to receive an email when new reports are released.

Since the first fears of the pandemic emerged in the U.S. in early March, businesses across the nation have endured six months of uncertainty. Yet, businesses are adapting and proving their resilience through lockdowns, reopenings, a summer surge in virus cases, new ways of doing business such as outdoor dining, new mask wearing rules and backlash from anti-mask patrons, as well as milestones such as the return to school. Even in the wake of increased closures we’re seeing businesses effectively transition to new operating models while keeping their employees and consumers safe.

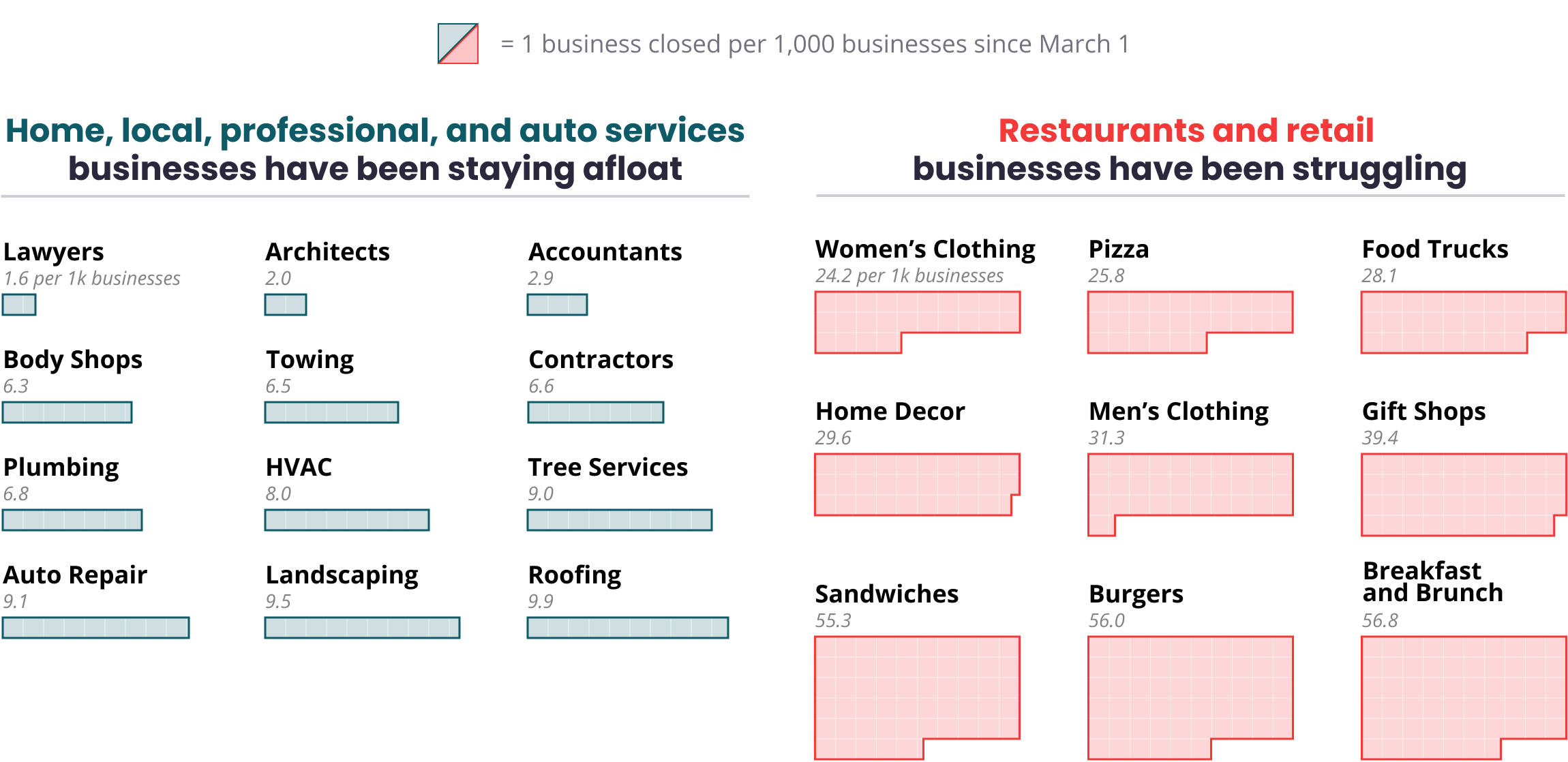

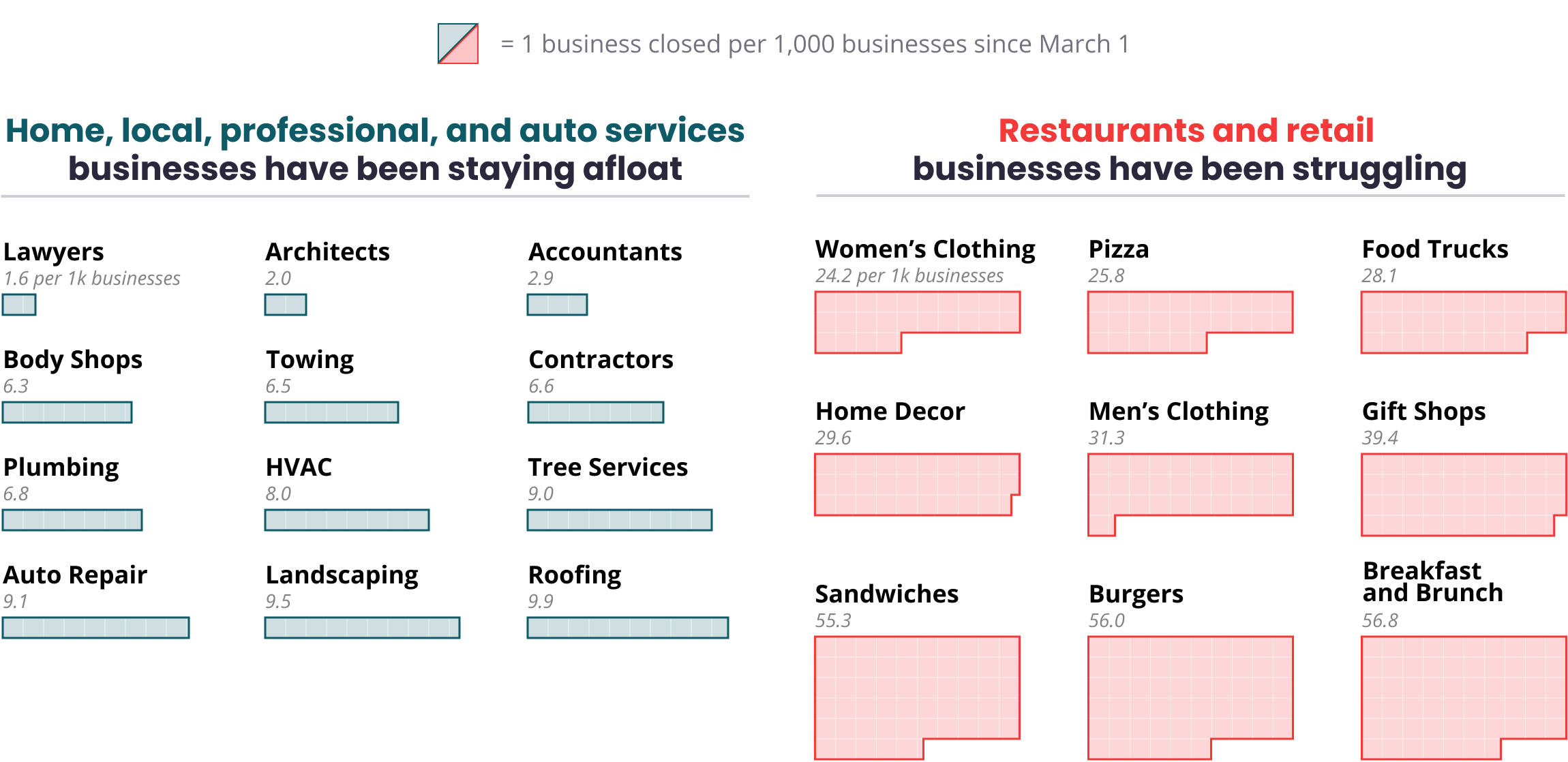

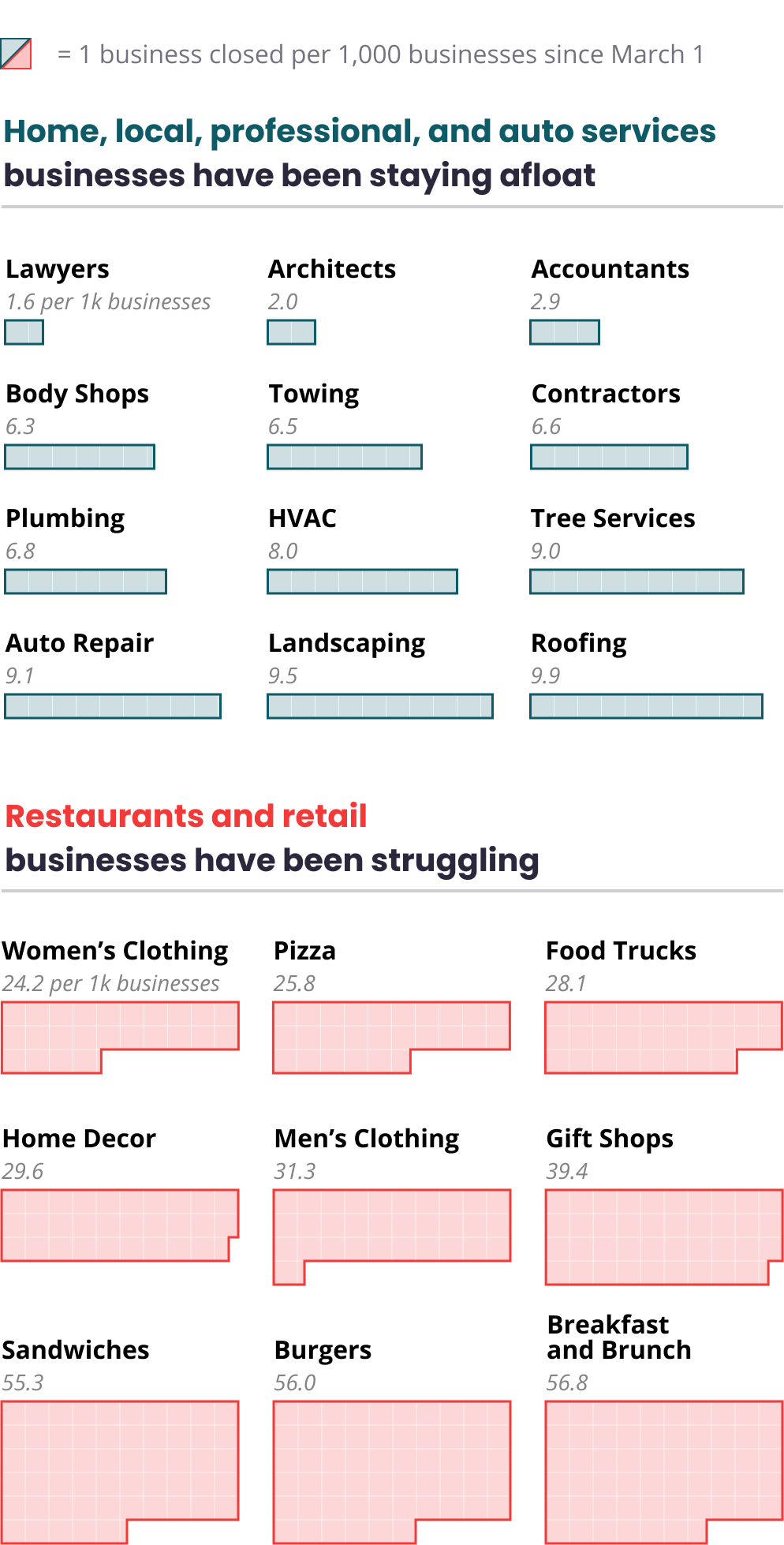

Yelp closure data shows that businesses providing home, local and professional services have been able to withstand the effects of the pandemic particularly well. But despite bright spots in some sectors, restaurants and retail continue to struggle and total closures nationwide have started to increase.

The last Yelp Economic Average showed a decreasing number of overall closures, 132,580 in total. As of August 31, 163,735 total U.S. businesses on Yelp have closed since the beginning of the pandemic (observed as March 1), a 23% increase since July 10. In the wake of COVID-19 cases increasing and local restrictions continuing to change in many states we’re seeing both permanent and temporary closures rise across the nation, with 60% of those closed businesses not reopening (97,966 permanently closed).

Business Closures Continue to Increase Nationally

Number of businesses marked closed on Yelp that were open March 1

Hover over a circle to see closures

Resilient Businesses Operating in an Unpredictable Economy

Some business sectors have been able to weather the COVID-19 storm particularly well. In general, professional services and solo proprietors as a whole have been able to maintain a relatively low fraction of closures since March 1. This group includes lawyers, real estate agents, architects, and accountants – all with only two to three out of every thousand businesses closed, as of August 31. Health related businesses in particular have been able to maintain a low rate of closures – orthopedists, internal medicine, hospitals, physicians, family doctors and OB/GYNs all have less than three closures out of every thousand businesses.

Yelp’s closure data also shows that demand for home, local and automotive services has remained robust with a far lower rate of closures compared to restaurants and retail. Towing companies, plumbers and contractors in particular have maintained a low rate of closures, with only six to seven out of every thousand businesses closed. In fact, the share of consumer interest in home and local services is up 24% between March 1 and August 31, relative to all categories on Yelp, compared to the same time last year.

Home, Local, Professional, and Auto Services Prove Their Strength Amid the Pandemic

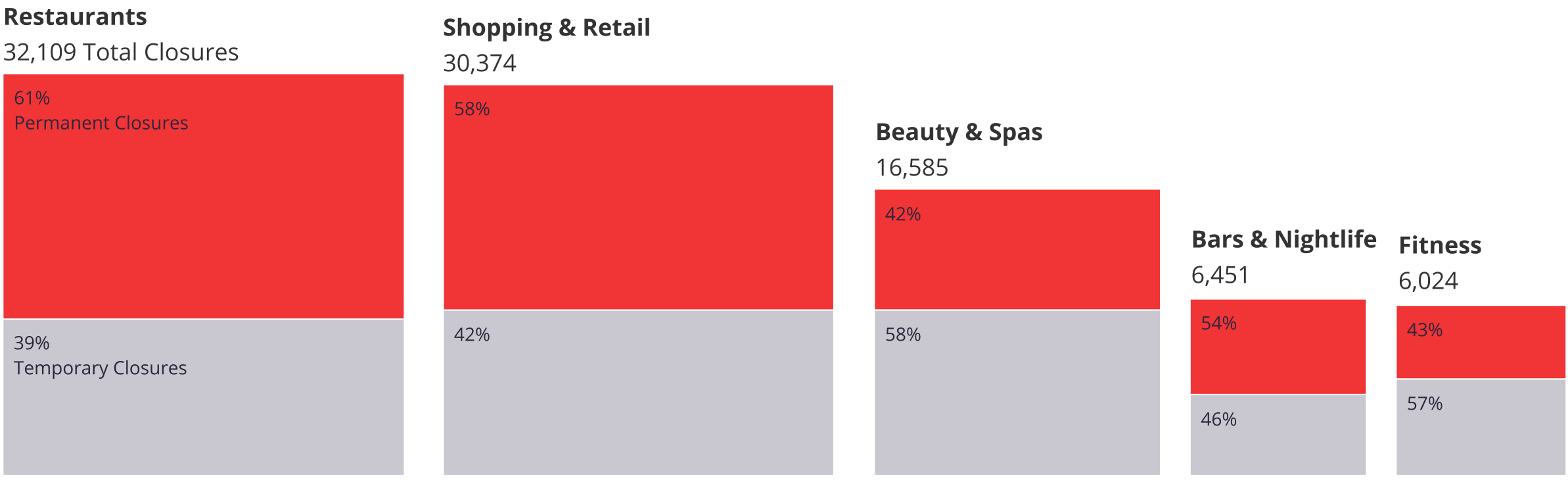

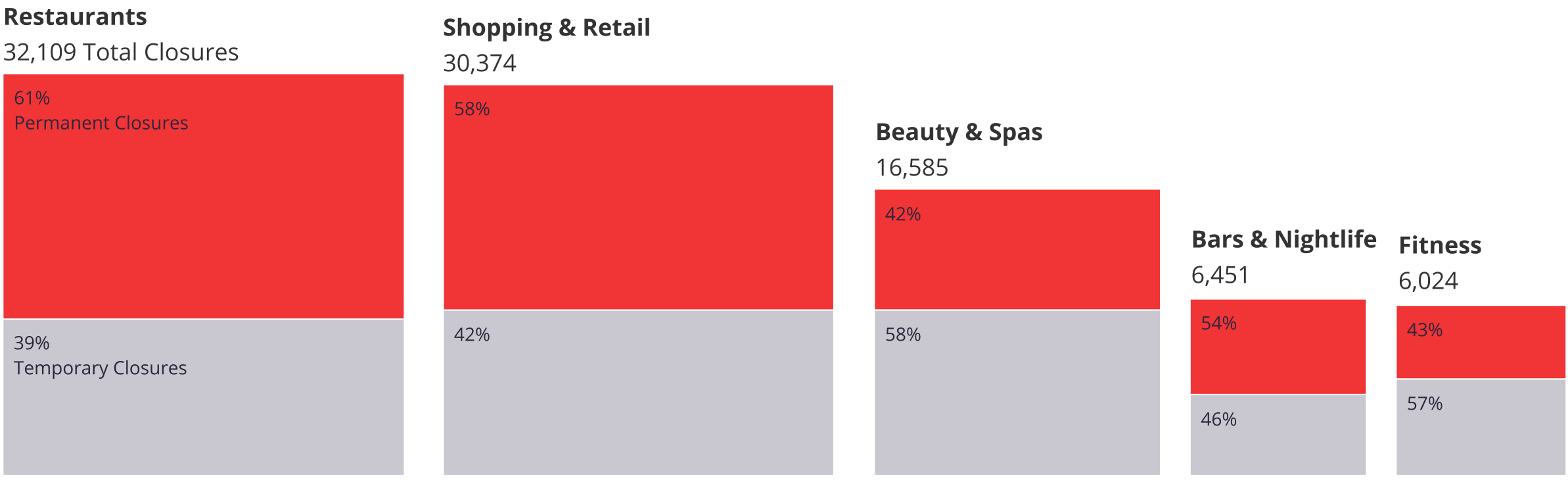

Restaurants Remain Hardest Hit, Permanent and Temporary Closures Increase

The restaurant industry continues to be among the most impacted with an increasing number of closures – totalling 32,109 closures as of August 31, with 19,590 of these business closures indicated to be permanent (61%). Breakfast and brunch restaurants, burger joints, sandwich shops, dessert places and Mexican restaurants are among the types of restaurants with the highest rate of business closures. Foods that work well for delivery and takeout have been able to keep their closure rates lower than others, including pizza places, delis, food trucks, bakeries and coffee shops.

Meanwhile, bars and nightlife, an industry 6X smaller than restaurants, has endured an especially high closure rate, with an increasing percentage of closures being permanent. As of the end of August there were 6,451 total business closures, of which 3,499 were permanently closed (54%). The share of permanent closures within bars and nightlife have increased by 10% since our Economic Average Report in July.

Retail and shopping follows closely behind restaurants with 30,374 total business closures, 17,503 of which are permanent (58%). Similar to bars and nightlife, the share of permanent closures increased by 10% since July. Both men and women’s clothing, as well as home decor, have the highest rate of business closures.

The beauty industry has seen a 22% increase in closures since July, totalling 16,585 closures. Of all closed businesses in the beauty industry 7,002 won’t reopen (42%), a significant 43% increase since July when we reported that 4,897 of all closures in the beauty industry were permanent. Similarly the fitness industry has endured a 23% increase in closures since July, with 6,024 total closures, 2,616 of which are permanently closed.

Restaurants and Retail Continue to Struggle

Number of businesses marked closed on Yelp that were open March 1

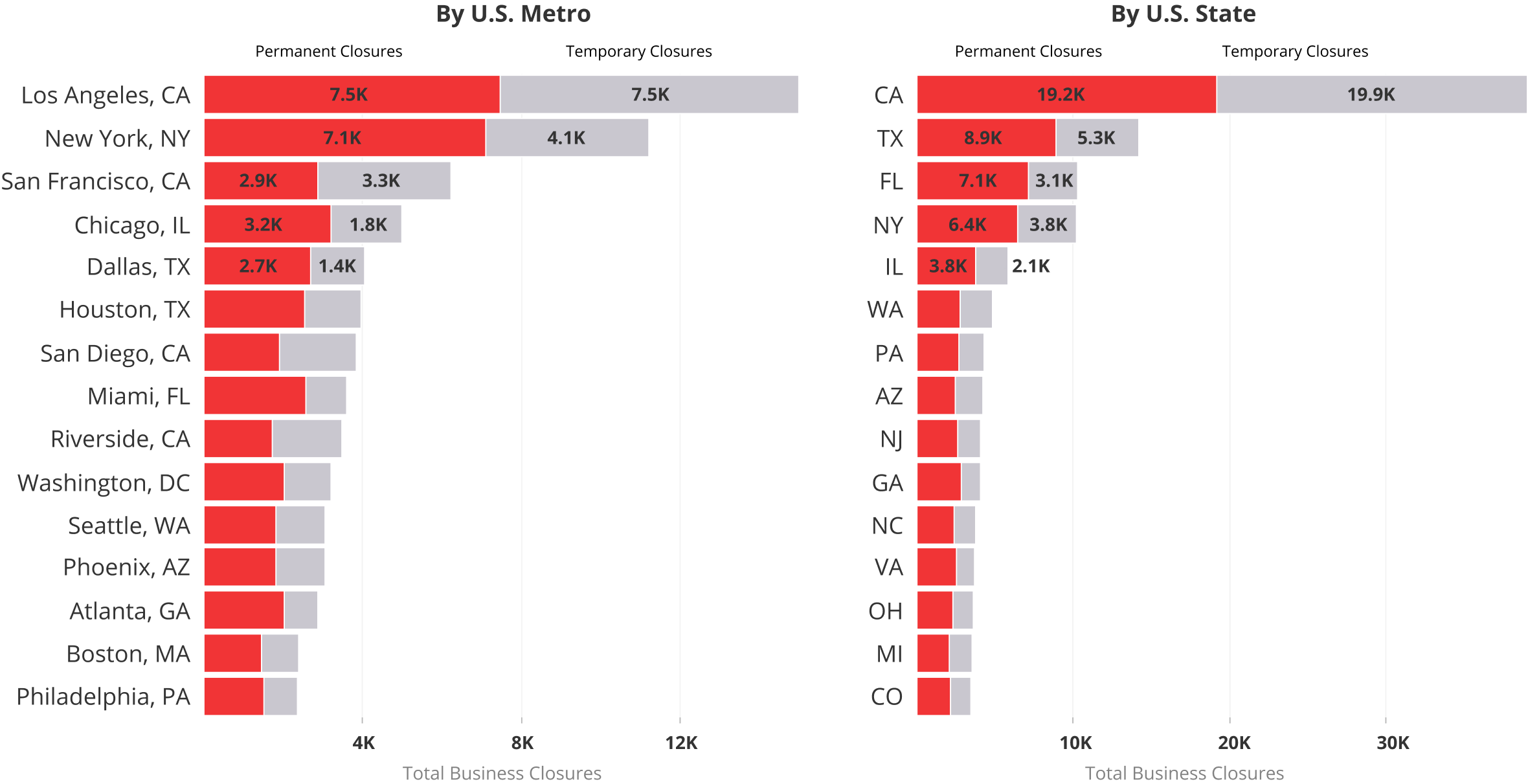

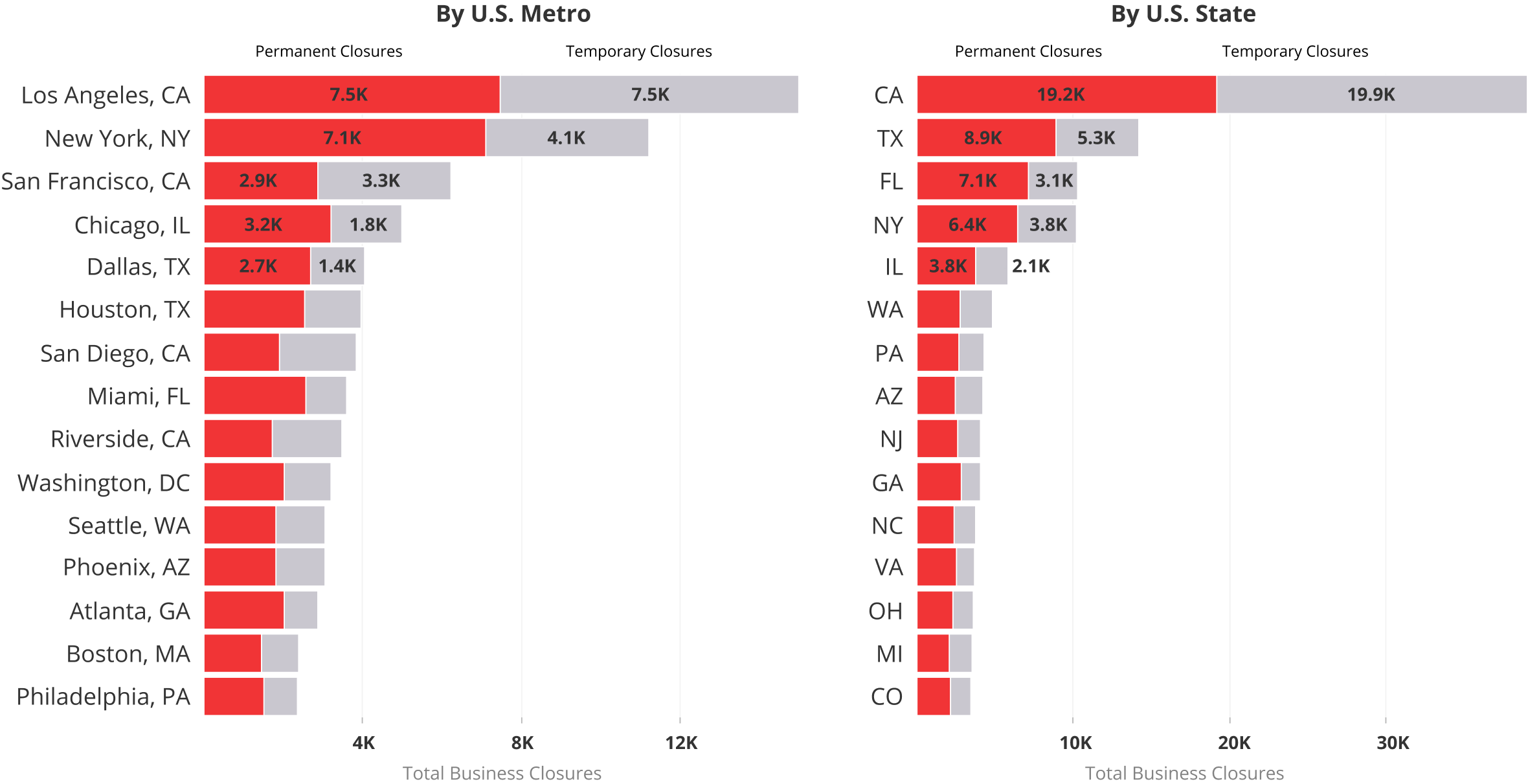

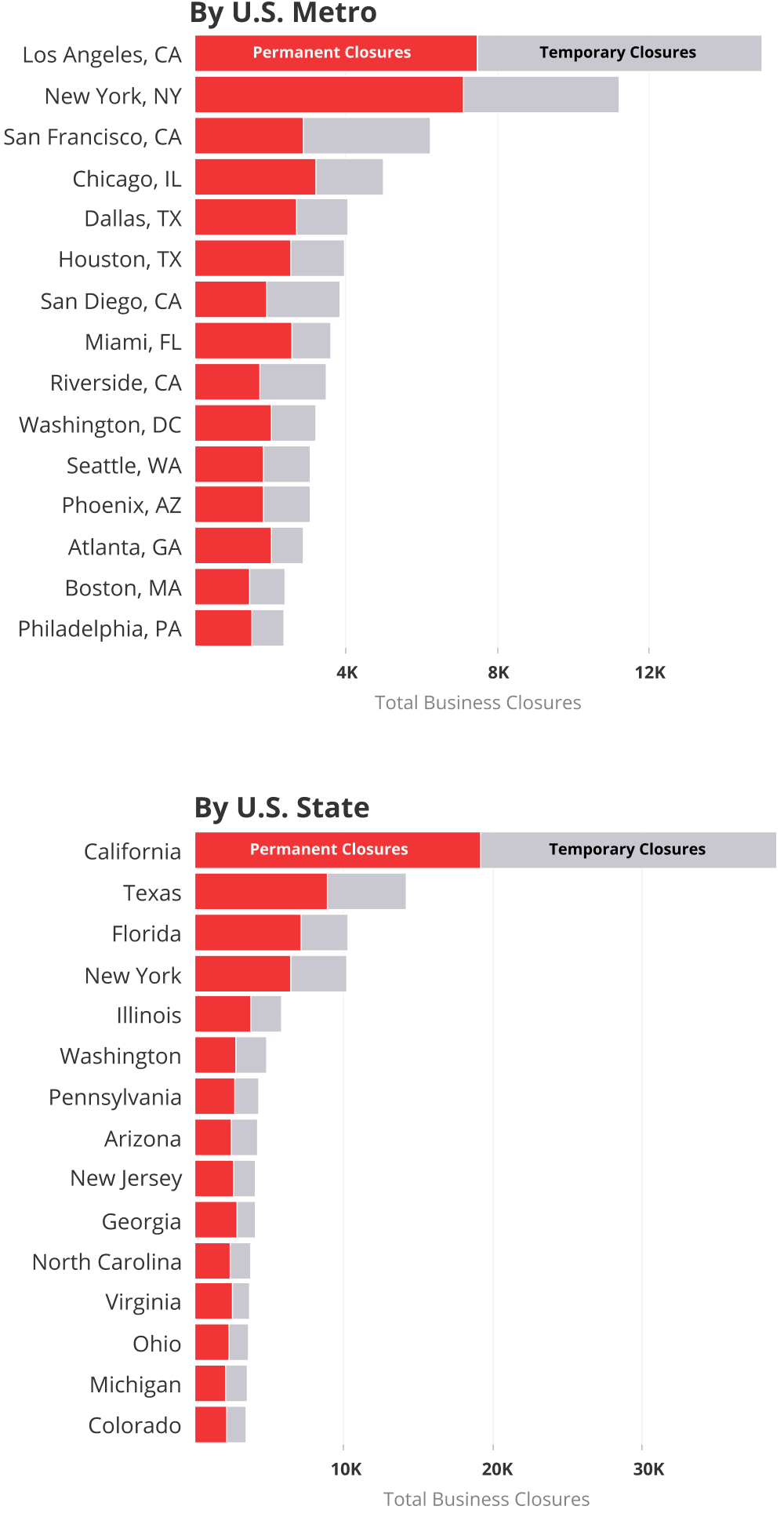

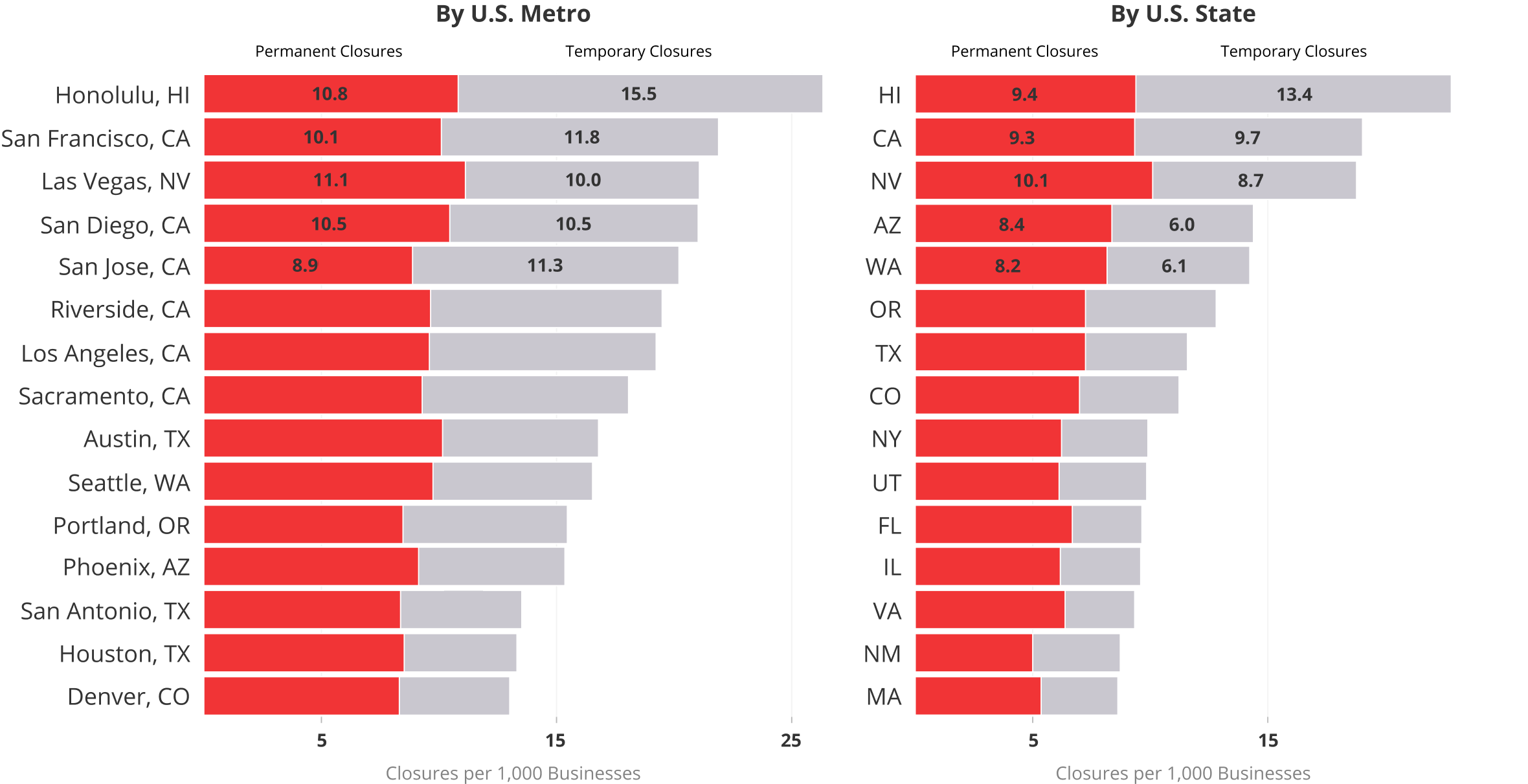

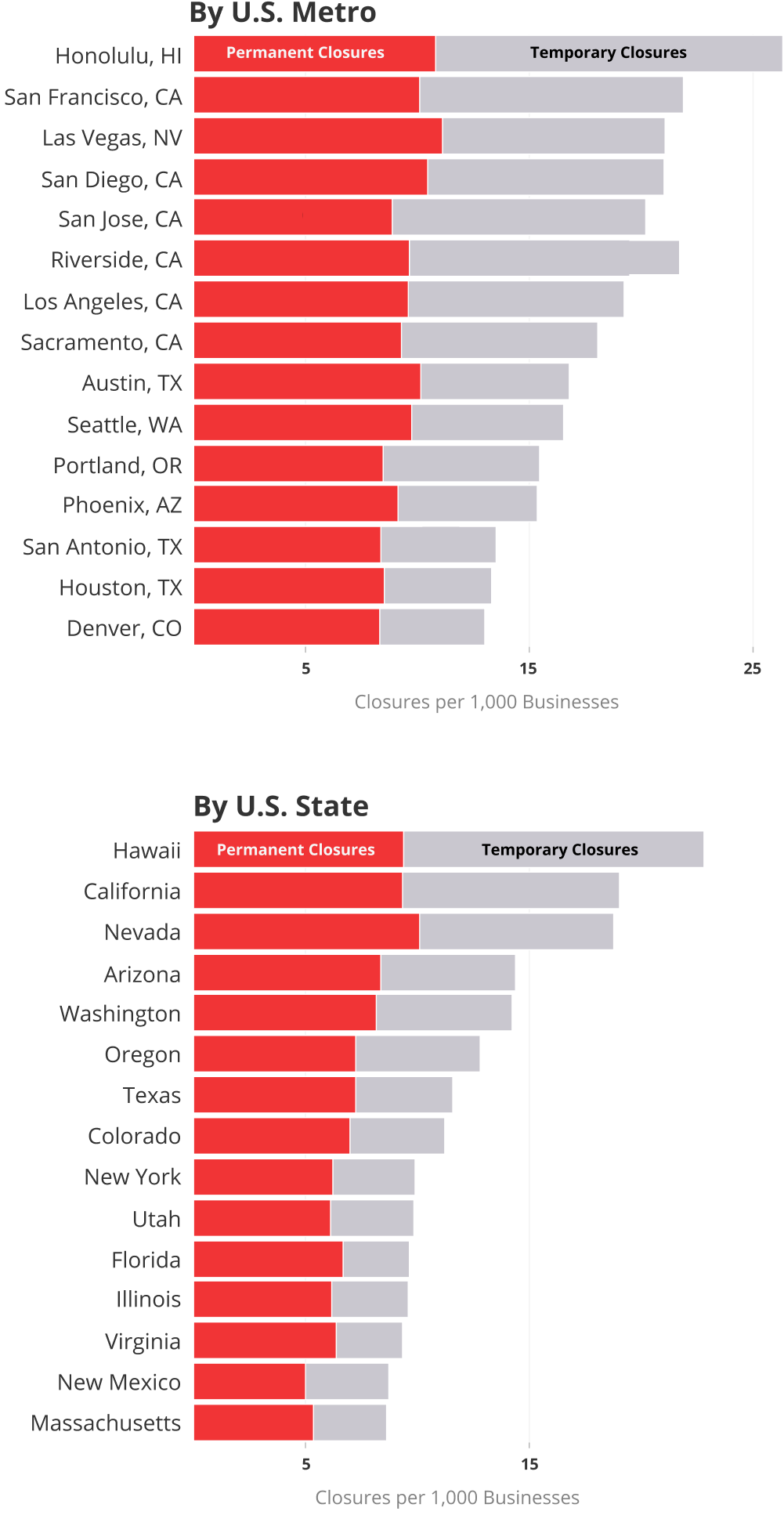

Larger States and Metros See a Greater COVID-19 Impact on Local Businesses

Even as the pandemic spreads nationally, geographically Yelp data shows business closure rates vary across the country. Bigger states and metros with higher rents and more stringent local restrictions for small businesses throughout the last six months have felt a greater toll. So have businesses more closely linked to physical locations that require crowds of consumers to attain profitability. Meanwhile, smaller cities and solo operations that can do their work one-on-one or virtually have proven better positioned to stay in business.

For the states with widespread business closures, the economic struggle appears to be closely coupled with unemployment rates. Hawaii, California, and Nevada have the highest rate of total closures and permanent closures – they’re also the three states with the highest unemployment rates, and among the biggest states for tourism. Meanwhile, West Virginia and the Dakotas have the lowest closure rates.

The states with the most closures are home to the hardest-hit metros: Las Vegas in Nevada, Honolulu in Hawaii, and several of the largest California urban areas all are among the metro areas with the highest total closure and permanent closure rates (San Diego, San Francisco, San Jose, Los Angeles and others), with roughly 20 businesses per thousand temporarily or permanently closing their doors since March 1. Larger metros with far fewer closures tend to be in the East, including Pittsburgh, Philadelphia, and Baltimore, all with closure rates below 10 per thousand.

Where are the Most Businesses Closed?

Geographic areas with the largest number of business closures since March 1

Keep an eye out for our next update in our Q3 Yelp Economic Average.

—Carl Bialik and Daniel Gole contributed to this report

If you'd like additional detail on how the economy is shifting, please contact us at press@yelp.com or join our mailing list to receive an email when new reports are released.

Interested in learning how Yelp data can assist you in developing market insights for your business? Yelp Knowledge can help, learn more here.

Methodology

Business Closures

On each date, starting with March 1, we count U.S. businesses that were open on March 1 and were closed on that day. Closure can be permanent or temporary, and is signaled by a business owner marking the business as closed, including by changing its hours or through a COVID-19 banner on its Yelp page. Closure counts are likely an estimate of the businesses most impacted, with many others not counted because they remain open with curtailed hours and staffing, or because they have not yet updated their Yelp business pages to reflect closures. Additionally, we only count closures that have been vetted by our User Ops team or have been updated directly by a business owner. Closures are counted by state, metro area, and category; some businesses are in more than one category. Businesses can also set automatic reopening dates on Yelp, which are counted as reopenings unless the business updates their information.

Downloadable static graphics can be found here.

See Yelp's previous Local Economic Impact Reports at our Data Science Medium, Locally Optimal.